U.S. corporations occasionally restructure by separating one part of their business into a new corporation and distributing shares of the new company to existing shareholders. For U.S. residents, these shares are known as spin-off shares, and Section 355 of the Internal Revenue Code (IRC) governs their tax treatment.

Spin-offs and how they work

A corporate spin-off occurs when a “distributing corporation” issues stock in a newly created or separate “controlled corporation” to its shareholders. The goal is often to separate distinct business lines or divest subsidiaries while maintaining shareholder continuity.

For example, if a U.S. technology company creates a separate cloud services company and distributes shares in that new entity to all its existing shareholders, those shares are considered spin-off shares. Section 355 determines whether the distribution is tax-free or treated as a dividend.

Tax treatment of spin-off shares

Under U.S. tax law, a spin-off can be tax-free to both the shareholder and the distributing corporation if the transaction meets strict Section 355 requirements. If the distribution does not satisfy these rules, the fair market value (FMV) of the spin-off shares is treated as a taxable dividend.

For tax-free spin-offs, the adjusted basis (or cost) of the original shares is allocated between the original corporation and the spin-off corporation. This ensures that any gain is deferred until the shareholder sells shares in either entity.

Example of basis allocation

Suppose a shareholder owns one share of the original corporation with a cost basis of $1,000. The corporation distributes 0.5 shares of a spin-off corporation, each with a fair market value of $600, while the original share has an FMV of $1,400.

The basis allocated to the spin-off shares is calculated as:

Allocated basis to spin-off shares = $1,000 × (0.5 × $600) ÷ ($1,400 + 0.5 × $600)

= $1,000 × 300 ÷ 1,700

= $176.47

Basis allocated to spin-off shares = $176.47

Adjusted basis of original share after spin-off = $1,000 − $176.47 = $823.53

The shareholder defers recognizing gain until a future sale of either the original or spin-off shares.

Eligibility for tax-free treatment under Section 355

There is a series of tests to qualify for tax-free treatment:

- Control Test. The distributing corporation must distribute at least 80% of the voting power and each class of nonvoting stock in the controlled corporation.

- Active Trade or Business Test. Both corporations must be engaged in active business immediately after the spin-off, and the businesses must have been active for at least five years.

- Business Purpose Test. The spin-off must have a valid corporate business purpose beyond tax avoidance.

- Device Test. The transaction cannot be used primarily to distribute earnings and profits disguised as a dividend.

If these requirements are satisfied, the spin-off shares are not taxed upon receipt, and the shareholder’s basis is allocated between the two entities for deferred taxation.

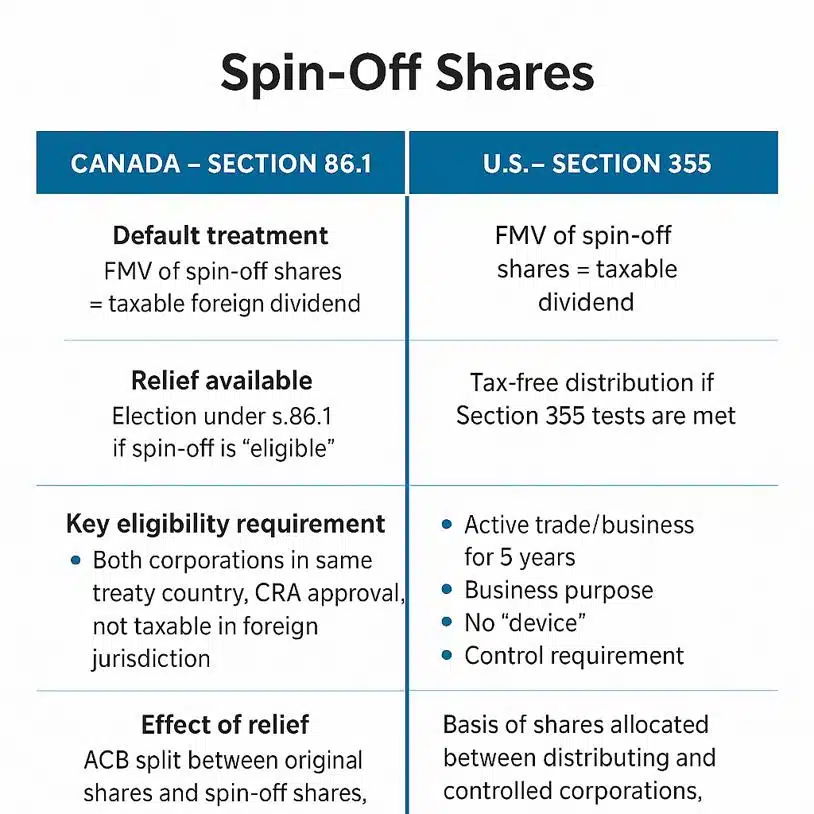

Here’s an infographic that summarizes how spin-off shares are treated by the CRA and IRS, respectively:

Pro Tax Tip – Confirm eligibility before filing

Because Section 355 has strict requirements, shareholders should verify that the spin-off meets all tax-free criteria. If any test fails, the FMV of the spin-off shares is taxable as a dividend in the year of receipt.

Professional guidance from a seasoned U.S. tax lawyer is strongly recommended to confirm eligibility, especially for cross-border shareholders or corporate reorganizations involving multiple jurisdictions.

Frequently Asked Questions

I received spin-off shares, but the company did not confirm Section 355 treatment. What should I do?

Consult a knowledgeable U.S. tax lawyer. They can confirm whether the spin-off satisfies all Section 355 requirements and advise on reporting. If the spin-off does not meet the requirements, the FMV of the shares must be reported as a dividend.

How is the shareholder’s basis allocated in a Section 355 spin-off?

The basis of the original shares is prorated between the original and spin-off shares using the FMV of both entities at the time of distribution. This allocation defers recognition of gain until shares are sold.

DISCLAIMER: This article provides broad information. It is only accurate as of the posting date. It has not been updated and may be out of date. It does not give legal advice and should not be relied on as tax advice. Every tax scenario is unique to its circumstances and will differ from the instances described in the article. If you have specific legal questions, you should seek the advice of a seasoned U.S. tax lawyer.