Foreign corporations sometimes restructure their business and distribute shares of a new or separate company to their existing shareholders. For Canadian residents, these shares are known as foreign spin-off shares, and special tax rules apply to their reporting.

Foreign spin-offs and how they work

When a Canadian resident shareholder owns shares in a foreign corporation (the “original corporation”) and that corporation distributes shares of another foreign corporation (the “spin-off corporation”), the shares received are considered spin-off shares.

This generally happens when a foreign corporation reorganizes itself to separate one line of business from another, or when it divests a subsidiary and distributes the new company’s shares directly to its shareholders.

For example, if a U.S. technology company creates a separate company for its cloud division and issues new shares of that spin-off to all its existing shareholders, Canadian residents who hold stock in the U.S. company would receive spin-off shares subject to Canadian tax rules.

Tax treatment of spin-off shares

By default, Canadian shareholders must include the fair market value (FMV) of spin-off shares in income as taxable foreign dividends in the year of receipt.

However, Section 86.1 of the Income Tax Act offers relief. If certain conditions are met, shareholders can elect to defer taxation on the receipt of the spin-off shares. Instead of reporting them as immediate income, the tax cost is adjusted between the original shares and the new spin-off shares.

The adjusted cost base (ACB) of the original shares is reduced, while the spin-off shares are allocated a portion of the ACB. This ensures that when either set of shares is later sold, the deferred income will eventually be recognized through capital gains.

Example of ACB adjustment

Suppose a Canadian shareholder owns one original share with a cost of $200 and a fair market value of $250. The corporation distributes 0.4 spin-off shares for each original share, and each spin-off share has a fair market value of $100. The shareholder therefore receives 0.4 of a spin-off share worth $40. By filing the election under Section 86.1, the shareholder can defer immediate taxation.

The ACB allocation is calculated as:

$200 × $40 ÷ ($40 + $250) = $200 × 40 ÷ 290 = $27.59

- ACB allocated to the spin-off shares received per original share = $27.59

- Adjusted ACB of the original share = $200 − $27.59 = $172.41

- Implied ACB per one full spin-off share = $68.97

The shareholder defers recognizing income until a future disposition.

When a spin-off is eligible under Section 86.1

The election under Section 86.1 is only available if the distribution qualifies as an “eligible distribution.” Key requirements include:

- The shareholder must be a Canadian resident (individual, trust, or corporation).

- The distribution must be of common shares of the spin-off corporation received in proportion to all the common shares of the original corporation.

- The spin-off shares must have been held by the original corporation immediately before the distribution.

- Both corporations must be resident in the same foreign country, which must have a tax treaty with Canada. Neither corporation may have ever been a Canadian resident.

- The original corporation’s shares must be widely held and actively traded on a designated stock exchange. If not, the corporation must be U.S. SEC-registered under the Securities Exchange Act of 1934.

- Under the foreign country’s tax laws, the spin-off must not be taxable to residents of that country.

- Within six months of the distribution, the original corporation must provide sufficient information to the Canada Revenue Agency (CRA) confirming eligibility.

If these conditions are satisfied, the CRA may publish the distribution on its list of eligible spin-offs. However, not all eligible spin-offs appear on the list—publication requires the foreign corporation’s consent.

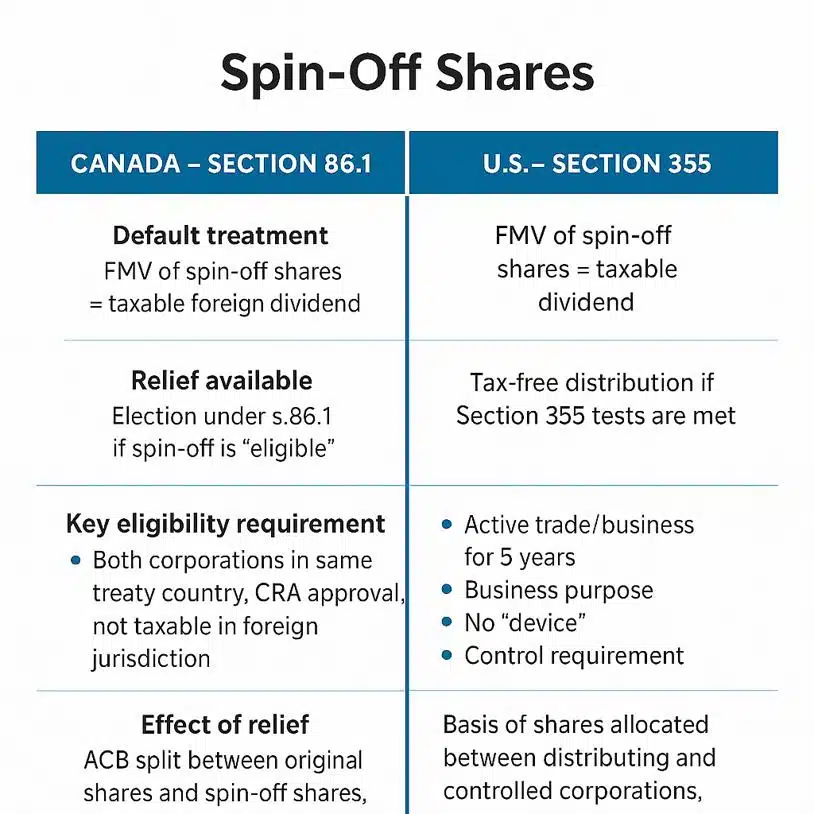

Here’s an infographic that summarizes how spin-off shares are treated by the CRA and IRS, respectively.

Pro Tax Tip – Confirm spin-off eligibility before filing

Canadian shareholders should not assume every spin-off qualifies for the Section 86.1 election. If the distribution is not eligible, the FMV of the spin-off shares must be reported as taxable foreign dividends in the year received.

Since some eligibility criteria depend on corporate disclosures or foreign law, investors should confirm with the original corporation whether the spin-off qualifies. When in doubt, written confirmation and professional guidance from an experienced Canadian tax lawyer can prevent costly mistakes and penalties.

Frequently Asked Questions

I received spin-off shares, but the CRA’s published list does not mention the distribution. Does that mean it is ineligible?

Not necessarily. The CRA’s list only includes spin-offs where the original corporation has consented to publication. Eligibility should be verified directly with the corporation or through professional tax advice.

I forgot to file the Section 86.1 election when I received spin-off shares. What can I do now?

If you missed reporting, you may still request relief. The CRA allows late-filed elections under taxpayer relief provisions, provided the request is made within ten years from the end of the relevant tax year. Consult an experienced Canadian tax lawyer to prepare and submit the request properly.

DISCLAIMER: This article provides broad information. It is only accurate as of the posting date. It has not been updated and may be out of date. It does not give legal advice and should not be relied on as tax advice. Every tax scenario is unique to its circumstances and will differ from the instances described in the article. If you have specific legal questions, you should seek the advice of a Canadian tax lawyer.